He said the commitment would span all areas of mutual interest, particularly trade, security, education and regional integration under the frameworks of ECOWAS and the African Union.

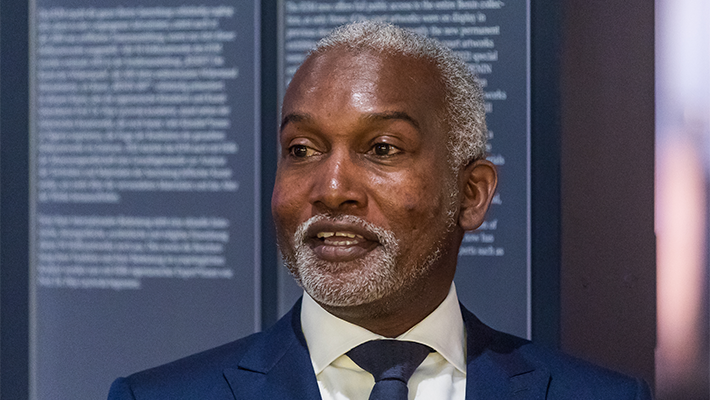

Tuggar disclosed this in a statement on Monday by Kimiebi Ebienfa, Spokesperson of the Ministry of Foreign Affairs, alongside his congratulatory message to Chadian Foreign Minister Mahamat Annadif.

The message was sent to mark the independence anniversary of the Republic of Chad.

Tuggar said: “As Chad marks the joyous anniversary of sovereignty and progress, Nigeria celebrates the resilience, unity and patriotic leadership of the Chadian people.

“The longstanding bilateral relations between our two nations, anchored on shared history, cultural affinity and cooperation, remain a source of pride.

“They are also a pillar of friendship and solidarity within the Lake Chad Basin, West Africa, and across the African continent.

“Nigeria reaffirms its commitment to deepening collaboration with Chad, especially in trade, security, education and regional integration under ECOWAS and the African Union frameworks.”

He commended Chad’s steadfast contributions to peace, stability and development in the region, particularly under the Multinational Joint Task Force.

Tuggar expressed hope that the strong bond between the two countries would continue to advance the prosperity of their citizens.

Credit: (NAN) (www.nannews.ng)