2026 Is About to Change How Nigerian Businesses Pay Tax

What every small business owner, startup founder, and digital entrepreneur needs to know before the new tax rules begin

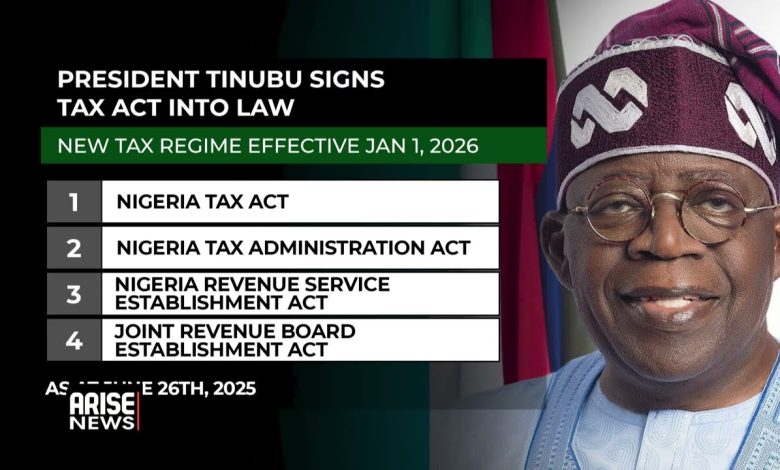

Big changes are coming for Nigerian business owners, and this time, it is serious. Starting from January 1, 2026, the way businesses and individuals pay tax in Nigeria will change under the Nigeria Tax Act 2025.

If you run a small business, a growing startup, or even an online business, these changes will affect you directly. This is not something to ignore or postpone. The goal of this guide is simple. To explain the new tax rules in clear language and show you what they mean for your everyday business life.

This is not legal grammar. This is real talk for real business owners.

What Is Really Changing in 2026

The 2026 Nigerian tax reforms for small businesses are designed to clean up the tax system, reduce confusion, and bring more businesses into the formal economy. Instead of many old tax laws scattered everywhere, the government is now bringing them together into one clearer system.

Here are the changes that matter the most to you.

Small Business Tax Relief Still Exists But With Conditions

If your business makes less than ₦100 million in a year, you can still enjoy tax reliefs or exemptions. That part is good news.

But here is the catch.

You must now keep proper digital records to qualify. This means clear records of sales, income, and expenses that can be verified electronically. If you are still writing sales in notebooks or relying on memory, you could lose these benefits.

The aim is simple. The government wants to stop abuse of tax exemptions and reward businesses that operate transparently.

Digital Businesses Are Now Fully on the Radar

For the first time, the law clearly recognises digital income.

If you earn more than ₦25 million annually from online activities like e-commerce, online training, freelancing, content creation, or digital services, you are now required to pay tax.

This change is part of the 2026 Nigerian tax reforms for small businesses to ensure fairness. Physical shop owners should not carry the tax burden alone while online businesses operate freely.

If your business earns money online, this is one section you should pay close attention to.

A New Revenue Service Is Taking Over

The Federal Inland Revenue Service will transition into a new body called the Nigeria Revenue Service.

What does this mean for you?

Fewer offices to visit.

Less paperwork.

More online processes.

The new system will rely heavily on digital platforms and smart tools to match declared income with actual business activity. Your bank records and declared earnings will now speak to each other automatically.

For honest businesses, this is good news. It creates fairness and removes guesswork. For businesses hiding income, the system will be harder to escape.

Changes to Personal Income Tax

Low-income earners earning ₦800,000 or less annually will remain tax free.

If you earn more than that, tax rates will range between 10 percent and 18 percent depending on your income level.

This structure is meant to protect low earners while ensuring higher earners contribute their fair share.

Capital Gains Will No Longer Be Flat

Selling property, shares, or even digital assets like crypto will now attract progressive tax rates instead of a single flat rate.

The more you gain, the more you pay.

This brings Nigeria closer to global standards and affects investors, traders, and business owners who frequently sell assets.

What This Means for Small and Growing Businesses

At first glance, the law may feel overwhelming. In reality, the core message is simple. Be transparent, go digital, and stay compliant.

The 2026 Nigerian tax reforms for small businesses focus on two major things.

Accountability

Businesses must keep accurate and traceable records. Manual bookkeeping is becoming risky. If you cannot prove your numbers digitally, you may face penalties or lose tax relief benefits.

Opportunity

Compliant businesses will benefit from incentives. The government plans to offer tax credits for businesses that adopt digital tools like online invoicing, payment systems, and accounting software.

Using tools like PearMonie to track income and issue receipts could move from being optional to being a smart business decision.

How to Prepare Before 2026 Without Stress

Preparation does not have to be complicated. Start small and stay consistent.

Move Your Records Online

Begin using simple digital tools to track sales and expenses. This protects you and makes reporting easier.

Separate Business and Personal Money

Open a dedicated business account. This alone can save you stress during tax assessments.

Know Your Business Category

Understand whether your business is micro, small, or medium. Each category comes with different obligations.

Train Anyone Handling Money

Staff members who receive payments or record sales should understand basic compliance.

Speak to a Tax Professional

A short consultation now can prevent expensive mistakes later.

Final Thoughts

The 2026 Nigerian tax reforms for small businesses are not designed to punish entrepreneurs. They are designed to create order, fairness, and trust in the system.

Businesses that adapt early will suffer less stress, enjoy incentives, and operate with confidence. Those who ignore these changes may struggle later.

The smart move is to prepare now, not in 2026.

If you run a business in Nigeria, this is your moment to step up, go digital, and stay ahead.